CGTMSE, or the Credit Guarantee Fund Trust for Micro and Small Enterprises, is a scheme introduced by the Government of India in order to provide financial assistance to micro and small enterprises (MSEs) by guaranteeing their loans. This scheme was launched in August 2000 and is managed by the Credit Guarantee Fund Trust for Micro and Small Enterprises, which is jointly owned by the Ministry of Micro, Small and Medium Enterprises, the Government of India, and the Small Industries Development Bank of India (SIDBI).

Under the CGTMSE scheme, MSEs can avail of loans up to Rs. 2 crores without any collateral security or third-party guarantee. This is particularly beneficial for small businesses that may not have the necessary collateral to offer as security for loans. CGTMSE provides a credit guarantee cover of up to 75% of the loan amount to the lending institution, which in turn reduces the risk for the lender and encourages them to lend to MSEs.

The benefits of the CGTMSE scheme are not just limited to the SMEs, but also extend to the lending institutions. By providing a credit guarantee cover, CGTMSE encourages lending institutions to provide loans to SMEs, which may otherwise be deemed risky. This in turn increases the lending portfolio of the lending institutions and helps them to diversify their risks.

In order to avail of the benefits of the CGTMSE scheme, SMEs need to approach a lending institution that has been registered under the scheme. The lending institution will then evaluate the loan application and if found eligible, will apply to CGTMSE for a credit guarantee cover. The application process for CGTMSE is simple and involves minimal documentation.

In conclusion, the CGTMSE scheme has been instrumental in providing financial assistance to SMEs in India. By guaranteeing their loans, it has reduced the risk for lending institutions and encouraged them to lend to small businesses. This has helped in the growth of the SME sector in India and has contributed to the overall economic growth of country.

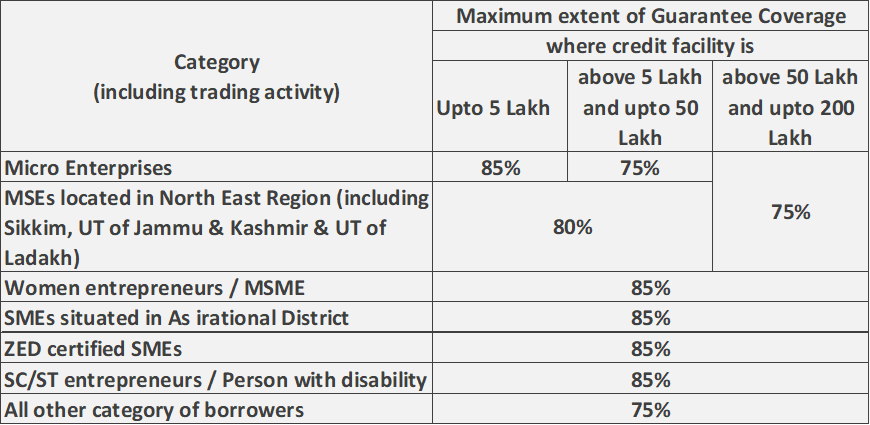

Below is extent of guarantee coverage as provided in case of different SMEs.

As per Annual Report FY22 from CGTMSE, 56,172 Cr of guarantee has been approved across 7,17,702 approved applicants. These are coming from 100+ lending partners including Banks, NSFCs and other financial institutions and 14% of beneficiary are women entrepreneurs.

CGTMSE has come afar now with multiple schemes as per requirements of industry and have launched Credit Guarantee Fund Scheme for Micro and Small Enterprises (CGS I), Credit Guarantee Fund Scheme for NBFCs (CGS II), Credit Guarantee Fund Scheme for Subordinate Debt (CGS-III) and Credit Guarantee Fund Scheme for PM-SVANIDHI (CGS-PMS).

CGTMSE has settled 1292 Cr of claims made in 65,784 units and Member Lending Institutions (MLIs) have been able to recover 166 Cr, post claim settlement. Standing strong shoulder to shoulder with SMEs of India CGTMSE has been working hard to bring forth the awareness among SMEs by being active in banking workshops, conclaves etc. With more robust APIs in place with connect to MLIs and growing book size of trust CGTMSE is bullish on growth of small entrepreneurs across the stretch of country.

Leave a Reply