In general trade, there is a buyer and a seller, buyer raises a purchase order to the seller against which the seller is obliged to ship the commodity to seller. Basis the received goods, post quality and quantity deductions buyer is obliged to pay to the seller the money basis there finalized payment terms.

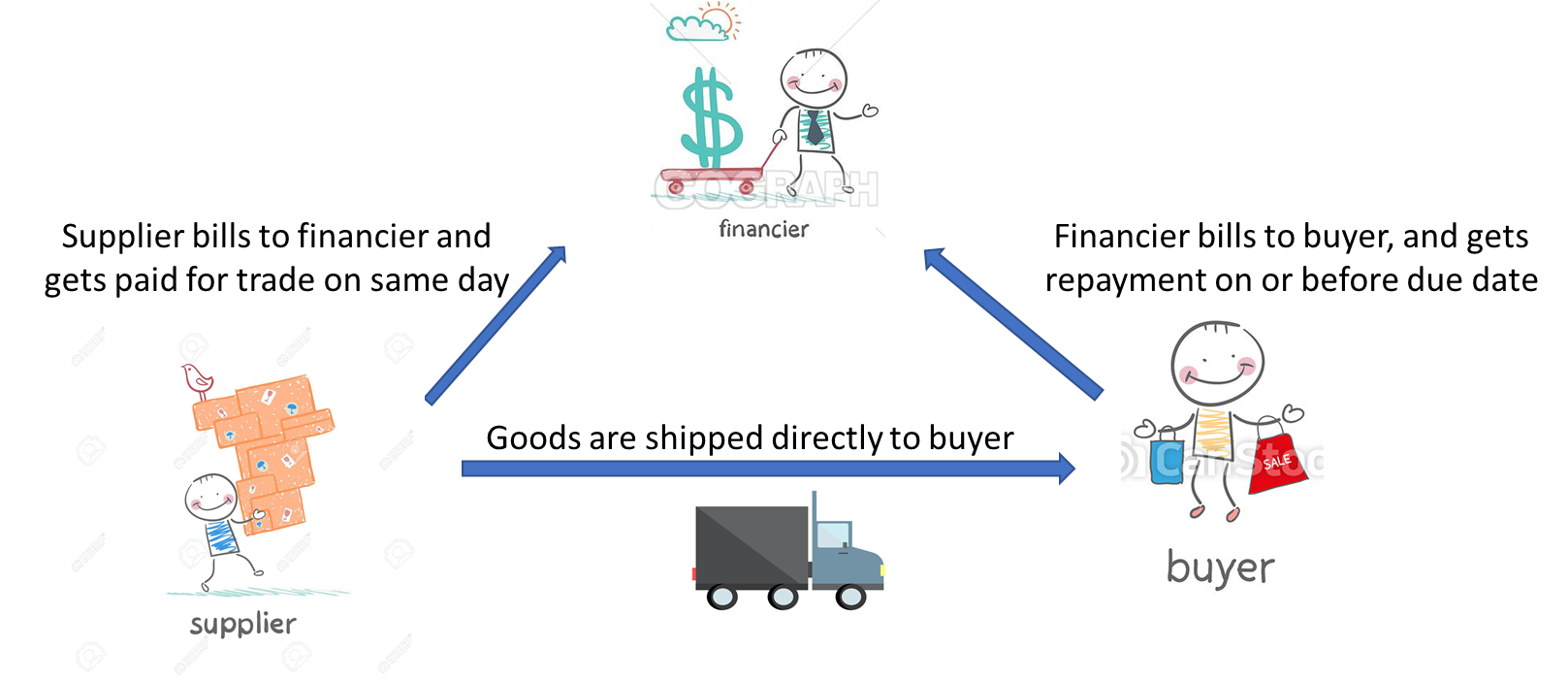

Now, let us consider our seller is asking for upfront payment without and the buyer is not in a position to pay it on same day due to less working capital with him, or due to shortage of funds. Buyer reached out to a financier to provide him solution. Here financier asked him to do trade in the bill-to-ship-to model. Here what will happen is the financier will buy from the seller on behalf of the buyer and sell it to him again. But will not hold the commodity and the seller will be directly shipping to the buyer’s address. So as name suggest bill to someone (financier in our case) and ship to someone (buyer in our case) is the idea behind this funding model.

Hence bill to financier and ship to the ultimate buyer is the gist of this trade model. Lets us discuss the advantages of getting this type of bill discounting facility –

- It allows you to expand the business as your working capital is not stuck in procurement and allows you a breather time period to pay back to financier.

- Also, since you are paying the supplier on the same day as when you trade, you have the advantage of getting a cash discount which ultimately is getting passed on to the financier for the credit period you will enjoy hence no extra cost is being added to your expenses. The below image summarises the bill-to-ship-to trade process.

- Last and not least since financier is ultimately a supplier in our buyers book, hence this facility will not show up in buyers CIBIL instead financier will be seen as sundry creditor in books.

Leave a Reply